The last one digit (Z) is the check digit.The next four digits (YYYY) is American Bankers Association (ABA) Institution Identifier.The first four two digits (XXXX) is the Federal Reserve Routing Symbol.The format of Routing Number is as follows:- XXXXYYYYZ The Routing Number is used by Federal Reserve Banks to process Fedwire funds transfers, and by the Automated Clearing House to process direct deposits, bill payments, and other such automated transfers. The abacus ( plural abaci or abacuses ), also called a counting frame, is a calculating tool which has been used.

#Abacus federal savings bank routing number code#

For international inward money transfer, a SWIFT code must be used together with a Routing Number and Account Number. 226072870 is the current routing transit number of Abacus Federal Savings Bank situated in city New York, state New York (NY). To make money transfer, the Routing Number is used together with the bank account number of the recipient.

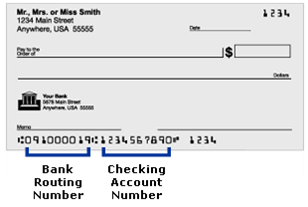

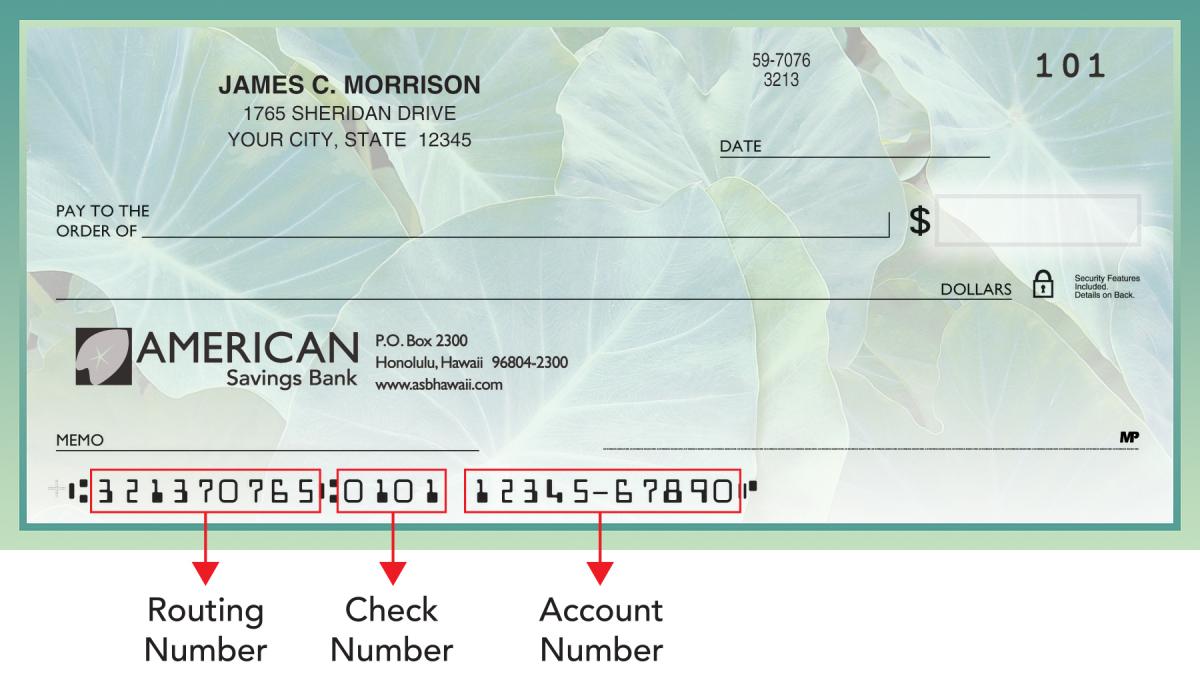

The Routing Number is used for domestic transfer. Routing Number: 226072870: Institution Name: ABACUS FEDERAL SAVINGS BANK : Office Type: Main office: Delivery Address: 104-116 NASSAU STREET, 10TH FLOOR, NEW YORK, NY - 10038 Telephone: 21: Servicing FRB Number: 021001208 Servicing Fed's main office routing. As new payment methods were developed (ACH and Wire), the system was expanded to accommodate these payment methods. The routing number 226072870 is assigned to ABACUS FEDERAL SAVINGS BANK. The ABA RTN was originally designed to facilitate the sorting, bundling, and shipment of paper cheques back to the drawer's (check writer's) account. To complete a wire transfer, the sender must provide his bank name and account number of the recipient, the receiving account number, the city and state of the receiving bank and the bank's routing number.An ABA routing transit number (ABA RTN) is a nine digit numerical code, used in the United States, which appears on the bottom of negotiable instruments such as cheques to identify the financial institution on which it was drawn. It is used for domestic or international transactions in which no cash or check exchange is involved, but the account balance is directly debited electronically and the funds are transferred to another account in real time. ACH Routing Numbers are used for direct deposit of payroll, dividends, annuities, monthly payments and collections, federal and state tax payments etc.įedwire Routing Number: Fedwire Transfer service is the fastest method for transferring funds between business account and other bank accounts. The last number is called as a check digit number which is a confirmation number. The next four numbers identify the specific bank. The first four digits identify the Federal Reserve district where the bank is located. ACH routing number is a nine digit number. Banks offer ACH services for businesses who want to collect funds and make payments electronically in batches through the national ACH network. Abacus Federal Savings Banking has made online banking so you can conveniently access your bank account wherever you are. ACH helps to improves payment processing efficiency and accuracy, and reduce expenses. This routing number is used for electronic financial transactions in the United States. Routing numbers may differ depending on where your account was opened and the type of transaction made.Įach routing number is unique to a particular bank, large banks may have more than one routing number for different states.ĪCH Routing Number: ACH Routing Number stands for Automated Clearing House (ACH). This number identifies the financial institution upon which a payment is drawn. The ABA routing number is a 9-digit identification number assigned to financial institutions by The American Bankers Association (ABA). ABA Routing Number: Routing numbers are also referred to as "Check Routing Numbers", "ABA Numbers", or "Routing Transit Numbers" (RTN).

0 kommentar(er)

0 kommentar(er)